Tuesday, December 26, 2006

The disappointing retail sales for this holiday season can be traced directly to the decline in the real estate market as consumers can no longer tap the equity of thier homes to spend elsewhere in the economy. Wall Street economists are "shocked" because they can no longer relate to the real economy due to their mighty status as the elite of this country. How can a Wall Street economist accurately predict what the masses will do, if he or she takes home millions in bonuses? These economists just assume everyone is doing well. Its impossible to feel the pain of the average broke American conusmer.

Monday, September 11, 2006

Saturday, August 12, 2006

Two great business quotes from the Financial Times:

On Business Travel-"90 percent of business trips could be cancelled with no damage to the business. People travel on business because it makes them feel important, because they are paranoid that something bad will happen if they do not and because they want air miles that will enable them to fly even more. Mostly, video conferences or phone calls would do instead. Business travel might be said to broaden the mind but it thins the bottom line and the ozone layer."--Lucy Kellaway

On Hedge Funds--"Robbed of its cloak of secrecy and its unconventional financing, private equity's stock picking looks all too human."

On Business Travel-"90 percent of business trips could be cancelled with no damage to the business. People travel on business because it makes them feel important, because they are paranoid that something bad will happen if they do not and because they want air miles that will enable them to fly even more. Mostly, video conferences or phone calls would do instead. Business travel might be said to broaden the mind but it thins the bottom line and the ozone layer."--Lucy Kellaway

On Hedge Funds--"Robbed of its cloak of secrecy and its unconventional financing, private equity's stock picking looks all too human."

Tuesday, August 08, 2006

Wednesday, July 26, 2006

Sayanora to the Transportation Average today which broke down. Say goodbye to the restaurants and the retailers. Money is rotating into the Dow and the S&P for now as they have held up relatively well so far. But as Joe Louis used to say about his opponents, "They can run but they can't hide" Eventually they will come for the big caps in the S&P 500 before the final rout is complete.

Monday, July 24, 2006

Adavanced Micro Devices (AMD) is one of the most hated stocks in the universe. Down over 60% from its high in March of above $42, it now sits at around $17 on huge volume. Many think AMD is over paying for ATYT, a Canadian based computer graphics chip company. Others think Intel is going to crush AMD in a price war to win back market share. I'm going to be the contrarian here and tell you that that the downside is limited, and its time to buy.

Tuesday, June 13, 2006

The shares of NYX closed today below 50. There were 7 new highs on the NYSE today, and 148 new lows. The Nasdaq recorded 17 new highs and 213 new lows. The percent of stocks below their 200 day moving average is now in the 40's. These are temporary extreme numbers. Sometime this week, with option expiration, we will make a tradable bottom. But longer term, to quote Yogi, " it aint over till its over" Now do you know why this blog is titled, "The I told you so Newsletter"?

Wednesday, May 31, 2006

This was the worst May in six years. The decline took no prisoners. A feeble rally today stopped the bleeding temporarily. The end of the month and the beginning of a new month are usually positive for stock prices because of the auto deduct-inflow into the mutual funds. After this money is used, we need to test the lows of last Wednesday which are 11,000 for the Dow;1245 for the S&P 500; and 1554 for the Nasdaq 100. The possible catalyst for the resumed downward test might come on Friday as the Government releases the Employment statistics for May. If the market is able to hold above these benchmarks, then a sustained rally can take place. If the market takes out these lows on a closing basis, then this correction is not over and we will be in for a difficult second half of 2006.

Saturday, May 06, 2006

When will the rise in interest rates peak? To answer this $64,000 question I had to look no further than my mailbox yesterday afternoon. A mortgage broker sent a mass mailing to me (presumably because my Home Equity Loan company sold him the mailing list) demanding that I lock in my prime based adjustable Home Equity Line of credit to a fixed rate. In bold 16 point type the letter stated, AFTER 15 STRAIGHT RATE INCREASES ISN'T IT TIME YOU DO SOMETHING ABOUT IT?? THE NEXT INCREASE WILL BE IN MAY, WHAT ARE YOU WAITING FOR? The ad goes on, "The Federal Reserve has increased rates 15 straight times in the last 4 years with no end in sight.....Most experts believe more increases are on the way."

I never got a letter from this guy after the first increase, or the the fourth or the seventh or the eleventh. Now I get one. Guess what? Rates will stop going up in the next 60 days. Case closed.

I never got a letter from this guy after the first increase, or the the fourth or the seventh or the eleventh. Now I get one. Guess what? Rates will stop going up in the next 60 days. Case closed.

Tuesday, May 02, 2006

"Sell in May and Go Away" I usually hate these wall street nursery rhymes. They are too cute and they seldom work. But this time, I believe that sometime in May will be the best sale of the year in the market. There are just two many things that could stymie the economy--interest rates, oil, Iraq, Iran, the fall of the dollar, rising commodities, etc. But one should look no further than the recent action of the NY Stock Exchange Group (NYX) which went public two months ago. Its down 30 points from the high and has given everything back from the time it first acquired Archipeligo. Conspiracy theorists would say the best time to sell would be after Thursday when the NYX completes it secondary offering. Regardless it is never a good sign of a healthy market when its feature IPO falls on its own weight over a mere two month period. The last time this happened was when ATT Wireless (AWE) failed to hold its IPO price in the year 2000 and we all know what happened next--- a 2 1/2 year bear market. The telltale signs here will be an S&P close under 1300 then under 1245 and if that happens, sayonara baby.

Sunday, April 09, 2006

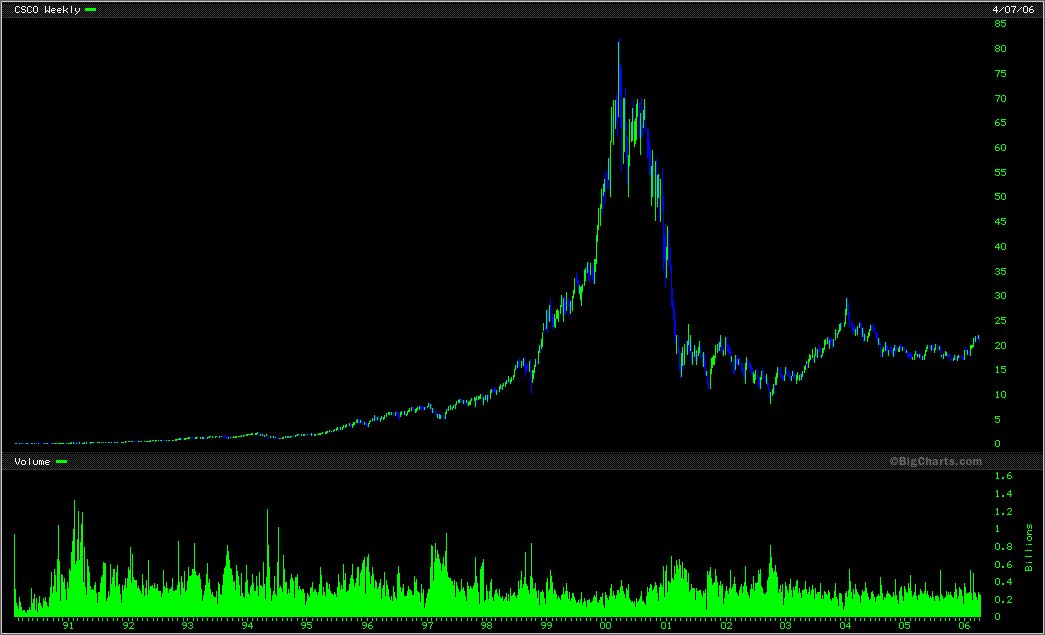

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

Wednesday, March 08, 2006

Right now, in the battle for cellphone supremacy, the market likes Nokia (NOK) and is selling Motorola (MOT), this is significant because this is a reversal in trend that has taken place over the last two years. Nokia has the momentum with new products and the money is flowing into NOK which at present is 19.50 and has a target in the mid 20's

Friday, January 20, 2006

The real estate market in the Northeast is DEAD. In January alone, I suspect business to be down 50-70%. The economy will slowly go into the toilet as the debt-laden consumer has no way out of his debts. The market is tanking today, the DOW is down over 150 points. Oil prices are once again on the rise even though its warm outside. Interest rates as a result should remain low, but there is no one left to borrow. Recession is almost a certainty as the Federal Reserve raised rates until the economy puked. Now its too late for them to do anything. The only thing that is working in investments is energy, gold and stocks of developing countries such as India, since they have all the computer jobs that workers in the US once had for $75,000, which Indians happily work for less than 1/10th the salary.

Monday, January 09, 2006

Two stocks for the new year--(EK) yes Eastman Kodak, and (PAY) Verifone. I like the management for both companies. I know that Kodak has pissed off everyone on Wall Street with their bullshit over the last 15 years. But I really think its different this time. Management finally has a plan and the switch to the digital age for Kodak will finally become reality. Verifone makes automatic credit card verification products. Wireless hand held is the hot new item and as more countries become wealthy, the need for more consumer transactions will naturally spurn growth.

Subscribe to:

Posts (Atom)