Sunday, July 13, 2008

Update on pawnshop operator EZ Corp (EZPW), originally recommended around $12 on March 23rd. As of Friday July 10th close it is now $16.36 having pre announced higher earnings for the quarter ended June 30th. Earnings are due out July 24th and there will be a conference call on the web. Unfortunately pawn shops are thriving in this very poor economy. This company seems to be a needle in the haystack of stocks which are suffering.

Tuesday, July 01, 2008

There are three phases to a bear market--denial, acceptance and capitulation. Last summer when Citi fell from 55 to 45 then to 35 analysts were pounding the table begging anyone that would listen to buy, buy, buy. This was the denial phase. Now we are hearing in the general media that we are in bear market territory down 20% on the Dow. Who ever came up with this stupid benchmark should be shot, but thats for another discussion. So now we are entering the acceptance phase, albeit reluctantly. Hey even GM was downgraded to sell by Goldman after making a 53 year low. You will hear the parade of talking heads on TV telling us "Don't Panic", there's "value" its close to the "bottom", yada yada yada. The same talking heads that thought that the housing sub-prime credit crisis was "contained" are now urging us not to panic. Funny isnt it???? After several months of acceptance we will be ready for the capitulation phase which will include more scandals, suicides and arrests, a forced liquidation of some more hedge funds that bet wrong, and stocks selling for seemingly unthinkable levels---Citi $5 anyone? Then and only then will the next fortunes be made. There will be light at the end of the tunnel and this time that light will not be in the form of an oncoming train.

Saturday, June 28, 2008

The Dow undercut its March and then its January lows settling around 11,346. The Dow is down almost 1700 points since mid May. The transports have cracked 5000 though this index is holding up much better. Banks and GM are finally being downgraded to sell. Only weeks ago you heard the mantra, stocks are cheap, its close to the bottom and all that other crap. Now reality has set in. Some hedge funds which are highly leveraged and bet wrong have to be in trouble. The VIX is no where near panic levels. Barron's has resigned itself to the belief that the financials won't recover until 2010. Wall Street analysts are biased, and therefore worthless. The only truth is in the charts. While a rally could surface some time in July, it should be a bear market rally which should be used to sell stocks and originate new shorts. A Dow rally into the 11,800 to 12,100 area would be the sweet spot for this action plan.

Saturday, June 21, 2008

We had our 800 point plus rally to over 13,000 on the Dow from the Bear Stearns panic bailout low in the low 12,000's. Now the Dow has dropped under 12,000 down over 1,000 points from mid May. We are teetering on the brink once more. The second half of this year in the stock market may very well be decided in the next 2 to 4 weeks.

Sunday, June 15, 2008

Big Brown and the stock market. Before the Belmont Stakes everyone was convinced that Big Brown would be the first horse in 30 years to win the Triple Crown. When reporters questioned why Big Brown would succeed where others have failed they were told, "Big Brown is different". In 1999 when internet stocks without earnings were selling for 140 times earnings (if they had earnings at all) and some companies with no sales had market valuations 10 times that of General Motors, journalists were told, "this time its different" Well the lesson of Big Brown as the lesson of the stock market is that its never different.

Sunday, April 20, 2008

Friday April 18th, the Dow closes over 12,800, the Dow Transports close over 5,000. At the same time new highs on the NYSE dwarfed new lows by 3 to 1. Bad new predominates, but the market does not care, it wants to go higher. For example HOG announced sharply lower slaes and layoffs, but its stock is in the same 37 area as it was a couple of months ago when we told everyone to cover their short. The market is sold out for now. Whether this up move is sustainable--only time will tell. We will not know this until Memorial Day. However, you cannot be short this market yet..... Trust the market, but as Reagan used to say, "verify"

Sunday, April 13, 2008

April will be the most important month in the stock market for 2008. It will resolve the issue as to whether the rally of the past two months was the beginning of a new up move, or just a blip in an ongoing bear market which started in the fall of 2007. So far the first 10 trading days in April goes to the bears. Especailly because GE a company who has gamed earnings for years, missed its estimated. GE is a bellwhether of the economy because of its broad industry reach. The market is failing and failing badly at a key technical juncture. Every rally into resisitance is met with failure. Unless the Dow can break above 12,800 along with a move by the Dow Transports above 5,000 it is still a bear market.

Tuesday, March 25, 2008

In this horrendous economy who profits? Pawn shops and pay day loan companies. Any business that provides temporary relief to struggling every day lower middle class working stiffs down on their luck. Demand for cash is great, and the cost of capital is ever being lowered by the Federal Reserve. Check out Cash America International on the NYSE (Symbol CSH) and EZ Corp on the Nasdaq (Symbol EZPW) Both companies are the prime benificiary of the current economic crisis.

Monday, March 03, 2008

What little respect I had for CNBC I lost today. This morning when Warren Buffett told Becky Quick that we are in a recession, she looked at him incredulously. Two seconds later, the bottom of the screen flashed a red "Breaking News".....Buffett says we are in a Recession. Duh!!!!!!!!!!!! Do these people live in the same world as the rest of us? I am tired of listening to these nitwits tell an unsuspecting public that---1. The subprime mess would not carry over into the general economy;and 2. That those who sold stocks last summer were stupid "lemmings" (according to Erin Burnett). I have learned more about the market from Tori Spellings reality show than from the biased talking heads on CNBC. Becky Quicks ignorance has personified this today and this speaks volumes about the financial media in general--they offer absolutely no value to an investor and probably detract from the sum total of all knowledge. What I do know is that we will probably have a nice tradeable bottom from here which is around DOW 12,200.

Tuesday, January 22, 2008

Todays Federal Reserve emergency action cutting the discount rate 75 basis points inter-meeting (the first time since 2001 such an inter-meeting action was taken) is nothing more than the Bank America Bail Out Plan. Last week, BAC took on the rest of Countrywide (CFC) and now the Fed has helped them by softening the cost of taking on the carcas of this crappy company. Almost 6 months to the day, we told you to short Harley Davidson (HOG) in the mid 60's. Well this morning HOG opened at 34.75!!Because of the fed action and because we have over 30 points in the trade, it is now time to cover the short. I think, err.... I know that HOG is going lower, but take the money because you never know how long this fed induced counter trend rally can last. You can always reshort after the gittiness ends. HOG has already bounced to the 37-38 area off the lows. So take that great trade off now.......

Monday, October 15, 2007

THERE IS NOT ENOUGH PAIN YET! The market has shrugged off the potential housing crisis as if nothing has happened. Even our short HOG dropped like a rock only to recover to 50. But this cheerfulness should be short lived. Economists have no clue how slow the real economy is. Just look at the roads. There is less traffic where I live despite fantastic weather. And gas prices have hardly budged even though crude futures set record highs daily. I am no genius, but even I can figure out that domestic US gas stations are seeing less demand. World demand must be incresing to justify $85 per barrel. But certainly not here. If the oil cracks then we will have a worldwide recession. If not, the recession will be contained only to the U.S. giving further credence that we do not matter as much as we used to.

Wednesday, June 20, 2007

With the real estate market malaise that we warned you about, and with interest rates ticking higher and gas prices, its obvious that adults don't have the same amount of $$$ to buy expensive toys. Thus Harley Davidson (HOG) is exhibit A as the type of company that will struggle from future sluggish sales. Short Harley Davidson, up to 66, with a buy stop above 70. If we are right about this one, the downside is almost 20 points to the low 40's.

Tuesday, December 26, 2006

The disappointing retail sales for this holiday season can be traced directly to the decline in the real estate market as consumers can no longer tap the equity of thier homes to spend elsewhere in the economy. Wall Street economists are "shocked" because they can no longer relate to the real economy due to their mighty status as the elite of this country. How can a Wall Street economist accurately predict what the masses will do, if he or she takes home millions in bonuses? These economists just assume everyone is doing well. Its impossible to feel the pain of the average broke American conusmer.

Monday, September 11, 2006

Saturday, August 12, 2006

Two great business quotes from the Financial Times:

On Business Travel-"90 percent of business trips could be cancelled with no damage to the business. People travel on business because it makes them feel important, because they are paranoid that something bad will happen if they do not and because they want air miles that will enable them to fly even more. Mostly, video conferences or phone calls would do instead. Business travel might be said to broaden the mind but it thins the bottom line and the ozone layer."--Lucy Kellaway

On Hedge Funds--"Robbed of its cloak of secrecy and its unconventional financing, private equity's stock picking looks all too human."

On Business Travel-"90 percent of business trips could be cancelled with no damage to the business. People travel on business because it makes them feel important, because they are paranoid that something bad will happen if they do not and because they want air miles that will enable them to fly even more. Mostly, video conferences or phone calls would do instead. Business travel might be said to broaden the mind but it thins the bottom line and the ozone layer."--Lucy Kellaway

On Hedge Funds--"Robbed of its cloak of secrecy and its unconventional financing, private equity's stock picking looks all too human."

Tuesday, August 08, 2006

Wednesday, July 26, 2006

Sayanora to the Transportation Average today which broke down. Say goodbye to the restaurants and the retailers. Money is rotating into the Dow and the S&P for now as they have held up relatively well so far. But as Joe Louis used to say about his opponents, "They can run but they can't hide" Eventually they will come for the big caps in the S&P 500 before the final rout is complete.

Monday, July 24, 2006

Adavanced Micro Devices (AMD) is one of the most hated stocks in the universe. Down over 60% from its high in March of above $42, it now sits at around $17 on huge volume. Many think AMD is over paying for ATYT, a Canadian based computer graphics chip company. Others think Intel is going to crush AMD in a price war to win back market share. I'm going to be the contrarian here and tell you that that the downside is limited, and its time to buy.

Tuesday, June 13, 2006

The shares of NYX closed today below 50. There were 7 new highs on the NYSE today, and 148 new lows. The Nasdaq recorded 17 new highs and 213 new lows. The percent of stocks below their 200 day moving average is now in the 40's. These are temporary extreme numbers. Sometime this week, with option expiration, we will make a tradable bottom. But longer term, to quote Yogi, " it aint over till its over" Now do you know why this blog is titled, "The I told you so Newsletter"?

Wednesday, May 31, 2006

This was the worst May in six years. The decline took no prisoners. A feeble rally today stopped the bleeding temporarily. The end of the month and the beginning of a new month are usually positive for stock prices because of the auto deduct-inflow into the mutual funds. After this money is used, we need to test the lows of last Wednesday which are 11,000 for the Dow;1245 for the S&P 500; and 1554 for the Nasdaq 100. The possible catalyst for the resumed downward test might come on Friday as the Government releases the Employment statistics for May. If the market is able to hold above these benchmarks, then a sustained rally can take place. If the market takes out these lows on a closing basis, then this correction is not over and we will be in for a difficult second half of 2006.

Saturday, May 06, 2006

When will the rise in interest rates peak? To answer this $64,000 question I had to look no further than my mailbox yesterday afternoon. A mortgage broker sent a mass mailing to me (presumably because my Home Equity Loan company sold him the mailing list) demanding that I lock in my prime based adjustable Home Equity Line of credit to a fixed rate. In bold 16 point type the letter stated, AFTER 15 STRAIGHT RATE INCREASES ISN'T IT TIME YOU DO SOMETHING ABOUT IT?? THE NEXT INCREASE WILL BE IN MAY, WHAT ARE YOU WAITING FOR? The ad goes on, "The Federal Reserve has increased rates 15 straight times in the last 4 years with no end in sight.....Most experts believe more increases are on the way."

I never got a letter from this guy after the first increase, or the the fourth or the seventh or the eleventh. Now I get one. Guess what? Rates will stop going up in the next 60 days. Case closed.

I never got a letter from this guy after the first increase, or the the fourth or the seventh or the eleventh. Now I get one. Guess what? Rates will stop going up in the next 60 days. Case closed.

Tuesday, May 02, 2006

"Sell in May and Go Away" I usually hate these wall street nursery rhymes. They are too cute and they seldom work. But this time, I believe that sometime in May will be the best sale of the year in the market. There are just two many things that could stymie the economy--interest rates, oil, Iraq, Iran, the fall of the dollar, rising commodities, etc. But one should look no further than the recent action of the NY Stock Exchange Group (NYX) which went public two months ago. Its down 30 points from the high and has given everything back from the time it first acquired Archipeligo. Conspiracy theorists would say the best time to sell would be after Thursday when the NYX completes it secondary offering. Regardless it is never a good sign of a healthy market when its feature IPO falls on its own weight over a mere two month period. The last time this happened was when ATT Wireless (AWE) failed to hold its IPO price in the year 2000 and we all know what happened next--- a 2 1/2 year bear market. The telltale signs here will be an S&P close under 1300 then under 1245 and if that happens, sayonara baby.

Sunday, April 09, 2006

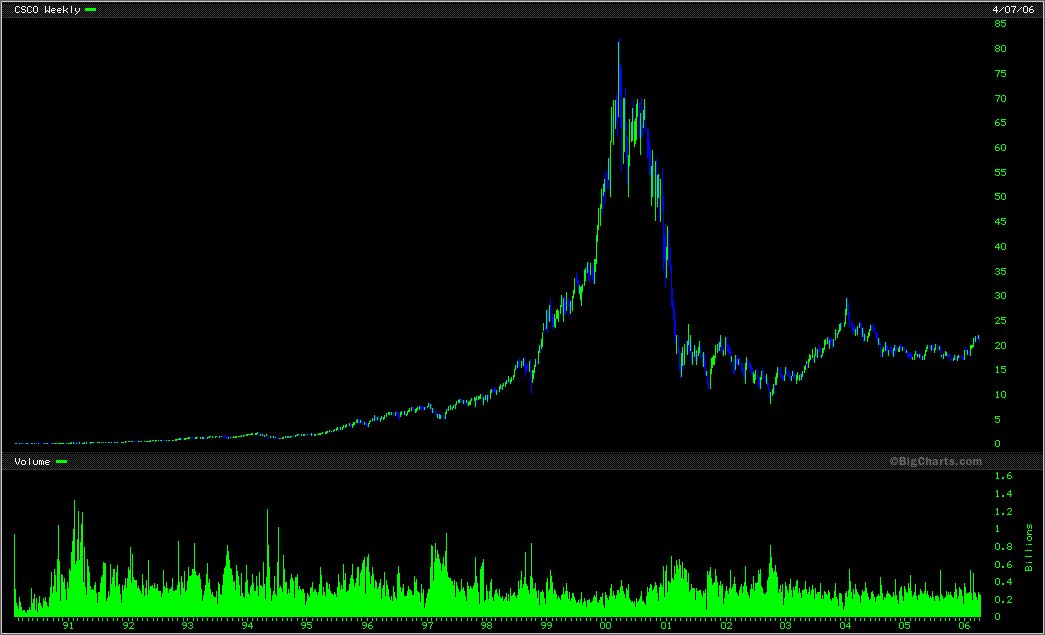

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

Wednesday, March 08, 2006

Right now, in the battle for cellphone supremacy, the market likes Nokia (NOK) and is selling Motorola (MOT), this is significant because this is a reversal in trend that has taken place over the last two years. Nokia has the momentum with new products and the money is flowing into NOK which at present is 19.50 and has a target in the mid 20's

Friday, January 20, 2006

The real estate market in the Northeast is DEAD. In January alone, I suspect business to be down 50-70%. The economy will slowly go into the toilet as the debt-laden consumer has no way out of his debts. The market is tanking today, the DOW is down over 150 points. Oil prices are once again on the rise even though its warm outside. Interest rates as a result should remain low, but there is no one left to borrow. Recession is almost a certainty as the Federal Reserve raised rates until the economy puked. Now its too late for them to do anything. The only thing that is working in investments is energy, gold and stocks of developing countries such as India, since they have all the computer jobs that workers in the US once had for $75,000, which Indians happily work for less than 1/10th the salary.

Monday, January 09, 2006

Two stocks for the new year--(EK) yes Eastman Kodak, and (PAY) Verifone. I like the management for both companies. I know that Kodak has pissed off everyone on Wall Street with their bullshit over the last 15 years. But I really think its different this time. Management finally has a plan and the switch to the digital age for Kodak will finally become reality. Verifone makes automatic credit card verification products. Wireless hand held is the hot new item and as more countries become wealthy, the need for more consumer transactions will naturally spurn growth.

Friday, December 16, 2005

Pfizer (PFE) bottomed out at $20 early this week. It does not have the same lawsuit exposure as Merck (MRK) and it just won a patent case vs. Indian drug manufacturer Ranbaxy. After hours this evening it is over $25. Go back and look at how many times PFE has rallied up 25% in one week. I bet you can count it on one hand in your lifetime. Buy, Buy, Buy!!

The best way to make use of any financial publication--be it Barrons, WSJ, IBD, The Financial Times, is to save any interesting article which focuses on a company you want to invest in for ONE MONTH. If you plunge in the day of the article, you will almost always pay a schmuck tax for all the hype. If the story is still valid one month from now, you will see it in the charts. If not, Mr. Market will have exposed it for the fraud that it is.!

Sunday, December 04, 2005

Technically, the S&P Retail Index (RLX) is forming a head and shoulders top amidst the Holiday Shopping Season. This is not good. Mr. Market is signalling perhaps, that the consumer is tapped out. That the home refinancing boom is over. That discretionary spending is dead. And Mr. Market does not discriminate among economic class lines. Tiffany (TIF) took a dive last week, as did Federated (FD) as did Radio Shack as did Target (TGT)

Tuesday, November 29, 2005

Tuesday, October 04, 2005

Last weeks rally was a feeble attempt at end of quarter mutual fund mark ups. The action was much weaker than expected. This is not how a bull market should behave. October is the cruelest month. Because we were wrong about the strong rally last week, it logically follows that October will be an especially cruel month on the downside. So, anyone with big profits should take a lot off the table before I say, I told you so.

Saturday, September 24, 2005

On Monday morning the stock market will correctly assess what the media has failed to do. After all, the media must over hype everything to keep people watching. But in reality Rita was not Katrina, and the market will have a rally next week that will be "one for the ages" The confluence of events--end of the quarter mark-up by the funds and falling oil prices will be the rocket fuel the market needs. Watch. Insurance, tech, even retail and the homebuilders will rally. Oil will fall like a lead balloon.

Thursday, September 01, 2005

Anyone with half a brain should sell their oil stocks. Remember these prices OXY $83, XOM $61, COP $69. And see what they are trading at a year from now. People have quadrupled their money on this run. Now the greed comes in because of the natural disaster. Put mother nature is telling you to sell not buy.

Wednesday, August 31, 2005

A tragic occurance in New Orleans, and Mississippi, skyrocketing oil prices. What will happen to the economy? My guess is that by this time next year the gas prices will be a lot lower less than $2.50/gallon. The alternative if I am wrong, is ugly. Everyone will stay in and watch movies. The economy will get clobbered. Interest rates will plummet, and Bush will lose the Republican majority in the House and Senate.

Sunday, August 07, 2005

This was Friday's Headline Aug 5, 2005--Touted as the Chinese Google, the search-engine operator opened at more than double the $27 IPO price, then surged for a 354% run to 122.54. Baidu.com was helped by talk that Google, (GOOG) which owns 2.6%, wants to buy it. The 1st-day gain ranks the 18th highest in history and No. 1 for a foreign firm's U.S. IPO. Some other Chinese net firms had solid gains.......Back in 2003 I wrote the following--The next big mania in stocks—China. In the next few years, hundreds if not thousands of new IPO’s will come to the market as Chinese ADR’s. At first, the supply of available companies will be small, causing the stocks to shoot straight up. Mutual funds that invest in China will become the hot funds. Chinese stocks will have internet like valuations as analysts try to justify the run-up using “new era” analysis.Then sometime in late 2006 Time Magazine will declare some Chinese entrepreneur as its Person of the Year. Months later the bubble will burst when the greedy discover that the “emperor has no clothes”; that the valuations were based upon fuzzy Chinese accounting; that there really weren’t any earnings. Sound familiar? The more things change, the more they stay the same.... It looks like we have at least another six months of the Chinese stock mania before it all starts tumbling.

Monday, June 06, 2005

Wednesday, April 27, 2005

Plantronics (NYSE:PLT) has imploded today, down almost 14%. Good things happen to those who wait. Cover half of the position today at about a $12 profit. High downside volume days with news are the best days to cover. You feel just like Eddie Murphy and Dan Akroyd at the end of the movie "Trading Places" when they were able to pick and choose which decimated commodities traders to buy from.

Wednesday, January 05, 2005

Wednesday, December 29, 2004

American Workers enrolled in Flexible Spending Medical Accounts will forfeit $210 million this year. This is money put away paycheck by paycheck for projected medical expenses during the year. The workers are given a tax deduction similar to that of an IRA. If the funds are not used they are forfeited and started anew. On average, workers contribute $250 to $3000 annually to these programs. So the US Government gloms this $210 million from "healthy Americans" and offers $35 million to the victims of the Tsunami. If the US Government conducted all its business this way, we would never have to worry about deficits and the demise of the Social Security System

Monday, December 20, 2004

For 2005 a basket of 5 contrary plays to buy. You have to buy all of them because some will be duds, but as a group, these should outperform the market. Pfizer $25 area (PFE) way over done; Time Warner $19 area (TWX) is this the year they finally spin off AOL?; El Paso $10 (EP) a natural gas company with financial problems; Rite Aid (RAD) $3.75 maybe someone pulls an Eddie Lampert with this one; and Lucent (LU) $3.75 the best of the worst in this beaten down telcom sector.

Friday, December 03, 2004

Has the hands free cellphone law been repealed? You would think so just driving around. Two years ago headphones were all the rage. Now that people have broken, lost, or misplaced them, they feel its their right to drive with one hand and talk on the phone with the other. The replacement cycle apparently never materialized. Plantronics (PLT-NYSE) is the leader here. The market has not fully discounted this trend yet. Short PLT here at $43 and add to your positions with any rally to $45-$46 with a stop over $48.

Monday, July 26, 2004

Thursday, June 24, 2004

Our IGT short sale has so far produced a $5 gain, we will monitor this closely as good news will propel the stock higher today. SGP is turning out to be a big winner, yet TWX is still sleeping. All eyes are on the June 30th confluence of events. HDI continues to make new highs as well. On July 1, we will recap the first half of the trading year and summarize how our picks are performing.

Sunday, June 06, 2004

Tuesday, May 25, 2004

Friday, May 21, 2004

A new investment idea in the face of rising oil prices--Harley Davidson (HDI) trades for around $56.50. Harleys have growing popularity with yuppies, wannabes, white trash, and aging baby boomers going through a mid life crisis. Now they can use the better fuel economy arguement to justify their purchase of a new Harley which they have been putting off for whatever reason.

The Dow Transports did not confirm the sell signal. The lowest the Transports traded was 2785 and rallied each time. The transports failed to take out the March lows below 2750 on a closing basis. There is still hope on the upside. Things to look for next week, falling oil futures (which of course helps the transports) and GE closing above 31 a very key level.

Thursday, May 20, 2004

Further anectodal evidence that the stock markets rally from Dow 7700 to Dow 10,500 this past winter is fizzing out---The news item about a wall street banker running up a $28,000 tab at Scores, a New York Strip Joint.

Three people ordered several bottles of a $3200 champagne, and spent $7000 on 350 lap dances at $20 per. Anybody with a clue knows that these stories don't come out at the bottom, but always at the top. I am still waiting for a story about Mexican cab drivers quitting thier jobs to become day traders!

Three people ordered several bottles of a $3200 champagne, and spent $7000 on 350 lap dances at $20 per. Anybody with a clue knows that these stories don't come out at the bottom, but always at the top. I am still waiting for a story about Mexican cab drivers quitting thier jobs to become day traders!

Monday, May 17, 2004

Some special situations in this dreary market. LEXR just signed a deal with Kodak (EK) for digital memory. LEXR is very, very oversold and at a good value around $9. SGP is close to FDA approval on a cholestorol drug. SGP sells for $16.50 and could in the next 6 to 18 months trade in the high 20's or more. TWX is a classic beaten down, turnaround situation. At 16.30 TWX management will do something in the near future to enhance the stock price.

Sunday, May 16, 2004

Short IGT, the slot machine company, one of the markets best performers over the past years is now on the verge of being a broken stock technically. Short it on any rally to the 40 area, add to your position, below 36. Cover your short for a loss above 43.25. The downside target is 24. I looked at this chart after reading a NY Times Magazine Cover Story about IGT and the slot machine craze last Sunday. Of course the article proclaimed IGT to be the "Microsoft" of slot machine technology. Of course this is a non-financial publication making a call on a national mania, well after the mania has been fully recognized by the stock market. They don't ring a bell at the top, but this article is as good as the December 1999 Time Man of the Year article on Jeff Bezos CEO of Amazon.com. At the time of that article AMZN was 116, it fell to 12 over the next 2 1/2 years. Need I say more?

Monday, May 10, 2004

Dow theorists now have half their sell signal, the Dow closed below 10,000 taking out its March closing low of 10,048. Now the transports must close below 2750 for a full blown sell signal. It closed slightly above 2800 today. I found some value today in MTF a large Japanese bank. It has fallen 30% since mid April. I believe in the turnaround in Japan after 23 years of malaise. Enough is enough already. Even though I feel good about buying the low on the opening today at $7.40, I will be wrong if MTF should close below $7.15. Always know where you are wrong when establishing any new positions.

Sunday, May 09, 2004

Gasoline prices up 15% this week. A gallon of regular is now $2.20. 30 yr. fixed rate mortgages approaching 7%, Health Insurance, Car Insurance, Insurance rates in general up double digits, college tuitions increases out paced inflation, New lows on the NYSE and NASDAQ now dwarfing new highs, food prices in the supermarket (milk especially) going through the roof. Inflation is back witha vengence!!! And this cannot be good for the economy. So much is tied to the price of gas, so many home equity loans tied to the prime rate, so many families barely getting by under the old prices, how will they survive under the new higher price environment??

Tuesday, May 04, 2004

Phony mortgage default rates---The media and housing experts will trumpet how low the mortgage default rates are by historical standards. This is misleading. The refinancing boom has masked the true underlying trouble many borrowers are in. After all, when you refinance out of a loan in default, or sell a home with a mortgage in default, that defauted loan is removed from the statistics in favor of a new fresh up to date loan, and so on. This game of mortgage musical chairs will soon play itself out as climbing interest rates, slow down the mortgage origination process. When the music finally grinds to a halt, then people will actually have to keep their payments up to date with (here's a novel idea) "Their Own Money!!" Only then will we see historic high mortgage default rates.

Thursday, April 29, 2004

Today, the NYSE had more 52 weeks lows than 52 week highs. I can't remember the last time this has happened. Gas prices are above $2 per gallon; 30 yr mortgage rates are at 6 months highs over 6% and Google has announced a $2.7 billion offering. All these factors weigh heavily on the market. The failure of the market to rally at the end of the month is further bad news. Today, fund managers who have to be invested were forced to hide in GE, while dumping all small cap and mid cap stocks.

Wednesday, April 28, 2004

Look out Below!!! We are heading into the mean season, the historically week period for stock prices (May to October). All the last minute IRA deposits have been sucked up by the funds. Where will the money come from for the new IPO's???? With interest rates trending up, oil prices trending up and an uncertain outcome of the Presidential election in November, the market is dazed and confused as it should be.

Sunday, April 11, 2004

If you don't think the real estate market is not at the top and at the verge of a long term decline, just notice the popularity of Donald Trump. He is everywhere and the media profiles are so out there you would have to be in a cave not to notice. Does the media flock to Trump at the bottom of the real estate market? No! It all comes out at the top!!

Thursday, January 08, 2004

Everything is rallying, the Dow and S&P are at 2 year highs, there were over 300 new highs on the NYSE and 2 new lows--MAT and KSS, 2 stocks you definitely do not want to own. Although some moron will go on CNBC soon and tell you what a great retail stock KSS is---Wall Street has been touting Kohls for years, never a negative thing said....What crap analysts are!

Thursday, December 04, 2003

Its the last month of an up year, the first up year in three. Money managers want their bonuses. So December is playing out this way--The biggest winners of the year, are getting hammered with profit taking. Look at the Chinese stocks (CYD for example) also stocks like, SNDK, LEXR, CECO, UPOX are getting slammed while the losers and small stocks are rallying. Sort of the "January effect" in December this year. Sell the winners and pick up some dreck like AWE, AETC, for last few weeks of the year.

Monday, October 27, 2003

Wednesday, October 15, 2003

The next big mania in stocks—China. In the next few years, hundreds if not thousands of new IPO’s will come to the market as Chinese ADR’s. At first, the supply of available companies will be small, causing the stocks to shoot straight up. Mutual funds that invest in China will become the hot funds. Chinese stocks will have internet like valuations as analysts try to justify the run-up using “new era” analysis.

Then sometime in late 2006 Time Magazine will declare some Chinese entrepreneur as its Person of the Year. Months later the bubble will burst when the greedy discover that the “emperor has no clothes”; that the valuations were based upon fuzzy Chinese accounting; that there really weren’t any earnings. Sound familiar? The more things change, the more they stay the same

Then sometime in late 2006 Time Magazine will declare some Chinese entrepreneur as its Person of the Year. Months later the bubble will burst when the greedy discover that the “emperor has no clothes”; that the valuations were based upon fuzzy Chinese accounting; that there really weren’t any earnings. Sound familiar? The more things change, the more they stay the same

Thursday, October 09, 2003

The risk reward ratio for Eastman Kodak (EK) is now 6 to 1 in favor of those willing to go long. In the next 18-36 months there is 5 to 6 points risk on the downside, and the potential of up to 30 points or more on the upside. I believe this is a risk well taken. And the stock still pays a 2% dividend.

Wednesday, August 06, 2003

9000 on the Dow is the last important support area, if this level is breached on a closing basis, Look out below! Interest rate update---- the 10 yr. bond yield has gone to 4.5% since our last commentary in July when it was 4.17%. The rate trend has reversed from down to up. Obviously the rate has gone up too much too fast, but the on balance trend in interest rates is now up. Homebuyers beware.

We landed on S&P 965 yesterday! This is support. But we got there on just the third trading day of the month. Therefore, one can only conclude, there is no juice in this market. The players are at the beach and they have taken their money with them. Be very careful. You can cover some of your shorts here and nibble on the long side, but doing nothing is probably the best advice in the month of August.

Monday, July 21, 2003

The mortgage refinance boom is over. If you did not refinance your mortgage its too late. The housing and mortgage companies will start to roll over and die. Look out below! Since our lst post on this subject on June 21, the 10 T-Bill (which mortgage rates are based) has gone up over 1% from a low of 3.09 to over 4.17% today. This is a tremendous move in a one month period of time. People dont even realize this and they will be shocked when they find out they did not lock in the rate at the time of their application.

Back to the stock market correction---Key support on the S&P exists in the 965 to 975 area. The Nasdaq can fall to 1600. Once we are there it will be the moment of truth, ie. is this a pullback with a great buying opportunity, or is it the next leg of the bear market. We are watching this very closely and once the evidence points overwhelmingly to one side of this argument, we will let everyone know.

Back to the stock market correction---Key support on the S&P exists in the 965 to 975 area. The Nasdaq can fall to 1600. Once we are there it will be the moment of truth, ie. is this a pullback with a great buying opportunity, or is it the next leg of the bear market. We are watching this very closely and once the evidence points overwhelmingly to one side of this argument, we will let everyone know.

Thursday, June 26, 2003

Saturday, June 21, 2003

Mortgage rates made 46 year lows last week, I believe that is the end of the low mortgage rate cycle for now. Stay away from all real estate related stocks, Homebuilders, Mortgage Lenders and Title Insurance Companies. Look to establish short positions in these sectors. The stock market correction/pullback/reversal is upon us. There may be end of the quarter strength but this is fake, and unsustainable. Look to sell into strength. There will be better prices ahead to buy. Dont turn profits into losses.

Monday, June 16, 2003

Friday, June 13, 2003

The market failed miserably today to follow through. This suggests that there will be a pullback to price levels that are worth waiting for. Wait until the S&P gets back to the 965-970 support area. This is a good area to buy stocks and cover any shorts. This is a good area to be long for the end of the month, end of the quarter rally later this month.

Thursday, June 12, 2003

The S&P Level was surpassed today on a closing basis; same for the Nasdaq, almost for the Dow but not quite. Friday the 13th will tell all. A strong Friday and the market will stay strong until the end of the month which is also the end of the quarter. At the end of the quarter, the funds mark up the stocks to pad their results.

Sunday, June 08, 2003

We took a 20% profit in SNE, and a 40% profit in GLW. So our model portfolio now consists of Short COCO-to be initiated this week; Long KROL@23.75, current price $23.89-hold; Long AETC@$2, current price $2.20; Long LEXR@$6.50, current price $7.97-Hold. Everything else in cash on the sidelines waiting for the market to come to us.

Saturday, June 07, 2003

If Fridays action was a rallying ending reversal day as I think it was, then the following highs reached intraday on June 6, 2003 should hold as the high for the move. Do not buy anything until these highs are surpassed or until we have a 10% pullback whichever comes first. The highs are: DOW 9215.88; S&P 500 990.14; NASDAQ 1646.01

Friday, June 06, 2003

Today might have been the end of the rally, or at least an excellent time to take profits on a 20% plus move in the averages. We sold SNE and, GLW from our model portfolio. As for the Dow, these stocks have lost their MOJO (to Quote Austin Powers) and did not even participate in this tremendous rally--- MSFT, IBM, JNJ, MMM--they are the true Dogs of the Dow. Avoid these like the plague.

Wednesday, June 04, 2003

Todays action looks like this rally is for real. After pulling back to the 965 support area, the S&P 500 reasserted its climb to the 986 level. If your stocks have not taken out Mondays highs, do not buy them, watch them very closely. Take profits on underperforming stocks, look to add to those stocks making new highs.

Monday, June 02, 2003

Fakeout or Breakout? The S&P vaulted over the 965 area this morning like a hot knife through butter, and closed in the 967 area. However the Dow as we told you catapulted to the 9000 area and sold off sharply at the close. Many stocks were a lot higher at 11 a.m. than where they closed. The highs for your stocks today must be used as a bench mark. Do not buy anymore stock or add to any position unless todays highs are surpassed sometime in the month of June. If they are not, than this is it for the rally! We can always buy a big pullback, do not chase anything at these levels.

Sunday, June 01, 2003

Model Portfolio Update- Long AETC@$2; current price $2.06 HOLD; Long GLW@5.50; current price $7.31-Hold, too late now to add to position; Long SNE@24.63; current price 27.34-Sell half of position and hold the rest; Long KROL@23.75; current price 23.22-Hold and look to sell below 22.90-this has been lagging in the rally; Long LEXR @$6.50- current price $7.40--Hold or add to position.

On Friday 5/30 the S&P 500 traded as high as 965.38 before settling at 963.59; A close above 965 and the Dow could easily run to the 9000-9100 area; a failure at 965 and the Dow could trade down to the 8400 level. Look for strength at the beginning of the month.... The closing prices at the end of June are crucial for the rest of the year in my opinion.

Friday, May 30, 2003

Thursday, May 29, 2003

Tuesday, May 27, 2003

Model Portfolio Update- Long AETC@$2; current price $2 HOLD; Short MTG @ 47.05; current price 45.05 sell more below 45; Long GLW@5.50; current price $6.02-Hold or add to position; Long SNE@24.63; current price 26.01-Hold or add to position above $26.63; Long KROL@23.75; current price 23.53-Hold; new purchase LEXR @$6.50- a play on digital photography.

More evidence that the Japanese stock market is at or close to the bottom: A number of suicide web sites have popped up in Japan where people contemplating suicide can meet others who are also contemplating suicide. The two meet at a roof top and jump together. Experts blame this behavior on more than a decade of economic malaise.

Sunday, May 18, 2003

Saturday, May 17, 2003

Thursday, May 15, 2003

Disney sold the World Champion Anaheim Angels for $185 million today. The entire team = $185 million. Ten years of Alex Rodriguez costs $255 million. The Texas Rangers I am told are worth less than the Angels. So who is better off Alex Rodriguez or the owner of the Texas franchise? A-Rod has a risk free deal--his owner can't say the same. But as in any mania---Stocks, gold, tulips the ridiculousness always comes out, and this my friends is no exception!

Wednesday, May 14, 2003

Tuesday, May 13, 2003

Monday, May 12, 2003

Our Model Portfolio to Date:

Long AETC @ $2; current price $1.91- Hold

Short IGT @86; covered at $89.05 for a $3.05 loss

Short MTG @47.05; current price $46.68-Hold; sell more below $45

Long GLW @$5.50; current price $5.90-Hold

Long SNE @$24.50 and $24.75; current price$24.53-Hold/Sell stop below $23

Long KROL@$23.75;current price $24.25-Hold

Long AETC @ $2; current price $1.91- Hold

Short IGT @86; covered at $89.05 for a $3.05 loss

Short MTG @47.05; current price $46.68-Hold; sell more below $45

Long GLW @$5.50; current price $5.90-Hold

Long SNE @$24.50 and $24.75; current price$24.53-Hold/Sell stop below $23

Long KROL@$23.75;current price $24.25-Hold

Friday, May 09, 2003

IGT has relieved us of our misery, teaching us the classic lesson-- dont short strong stocks in strong markets.... Gabelli nets $37 million last year as his funds returned -30% to investors...... Nobody wants to tap the Settlement Fund for research. The researches say its not enough to justify their work. Heads of research firms are saying, "Free research is garbage" Didnt investors know this??? Or did they just take dumb pills?

Thursday, May 08, 2003

This weekend we will detail our model portfolio to date. Kohls (KSS) Dept Stores is on our stocks to short radar list. Have you ever been to one? Its overrated dreck. And so is the stock. We are short MTG at 47.05 and still short IGT (barely) We picked up a long position in KROL on a nasty pullback today. The full list will be out this weekend.

Wednesday, May 07, 2003

Here is a novel theory, Wall Street analysts just wrote glowing reports about the airline industry to show the government that they are not all bad. After all, propping up a potentially bankrupt industry, relieves the U.S. government of another potential headache that it must deal with. Maybe this was part of the recent Settlement made in the poverbial smoke filled room?

Tuesday, May 06, 2003

LABL a commercial products labeling company in some of the very same businesses as AETC, broke out to a new high today above $19 share on improved earnings. So, fundamentally the labelling business for products such as chewing gum, soda and cleaning products is sound. Now the company AETC must get their story out.

The new hot tech product is Satellite Radio. Several new car companies have signed contracts with XMSR and SIRI. Taking a page out of the cable TV concept, subscribers pay $10-$12 per month for programming signals which can be picked up anywhere in the country. XMSR has been a rocket ship, up 250% in the past 45 days. SIRI just broke above $1 today for the first time in ages. Will the concept work? Who cares! There are only two ways to play and the small cap funds are chasing a limited supply of stock.

Monday, May 05, 2003

Slightly positive article in yesterdays Sunday Times Business section on the Corning (GLW) turnaround story..... We are recommending a low price speculation AETC @ $2 per share. They make the wrappers for candy and the 2 litre Soda bottles. There is value there. Its just laying there waiting to be noticed by someone.

Sunday, May 04, 2003

Our horse went off at 9 to 1 odds. He had the #3 position, started poorly, could not keep up with the fast early pace, found himself 12th at the half mile mark. He kicked into another gear as he passed horse after horse in the stretch to finish 4th. Not bad, but nobody gets paid for 4th place if you are a bettor. Lets see if he is entered in the Preakness.

Subscribe to:

Posts (Atom)