When will the rise in interest rates peak? To answer this $64,000 question I had to look no further than my mailbox yesterday afternoon. A mortgage broker sent a mass mailing to me (presumably because my Home Equity Loan company sold him the mailing list) demanding that I lock in my prime based adjustable Home Equity Line of credit to a fixed rate. In bold 16 point type the letter stated, AFTER 15 STRAIGHT RATE INCREASES ISN'T IT TIME YOU DO SOMETHING ABOUT IT?? THE NEXT INCREASE WILL BE IN MAY, WHAT ARE YOU WAITING FOR? The ad goes on, "The Federal Reserve has increased rates 15 straight times in the last 4 years with no end in sight.....Most experts believe more increases are on the way."

I never got a letter from this guy after the first increase, or the the fourth or the seventh or the eleventh. Now I get one. Guess what? Rates will stop going up in the next 60 days. Case closed.

Saturday, May 06, 2006

Tuesday, May 02, 2006

"Sell in May and Go Away" I usually hate these wall street nursery rhymes. They are too cute and they seldom work. But this time, I believe that sometime in May will be the best sale of the year in the market. There are just two many things that could stymie the economy--interest rates, oil, Iraq, Iran, the fall of the dollar, rising commodities, etc. But one should look no further than the recent action of the NY Stock Exchange Group (NYX) which went public two months ago. Its down 30 points from the high and has given everything back from the time it first acquired Archipeligo. Conspiracy theorists would say the best time to sell would be after Thursday when the NYX completes it secondary offering. Regardless it is never a good sign of a healthy market when its feature IPO falls on its own weight over a mere two month period. The last time this happened was when ATT Wireless (AWE) failed to hold its IPO price in the year 2000 and we all know what happened next--- a 2 1/2 year bear market. The telltale signs here will be an S&P close under 1300 then under 1245 and if that happens, sayonara baby.

Sunday, April 09, 2006

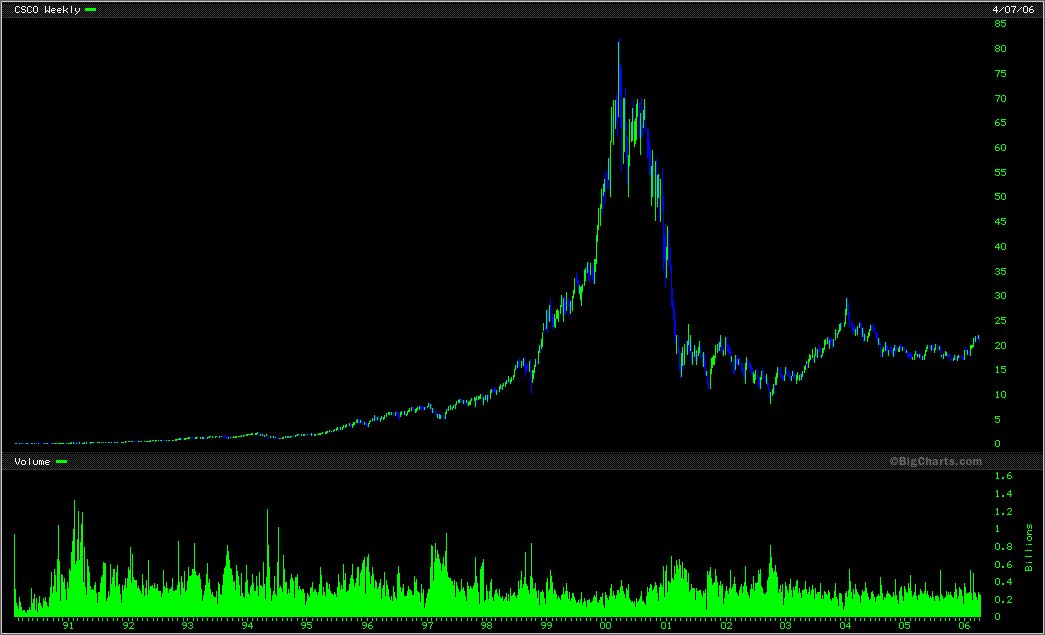

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

CSCO and the Yankees. Both had a great run from 96 to 2001. Both despite the greatness of their product, are yesterdays news. The Yankees announced that after today they will not accept any more season ticket subscriptions for the remainder of the season. Demand is red hot for yesterdays news. Just like the CSCO shareholders watched the stock plummet from 80 to 10. Just like the band on the Titanic which continued to play as the ship sunk.

Wednesday, March 08, 2006

Right now, in the battle for cellphone supremacy, the market likes Nokia (NOK) and is selling Motorola (MOT), this is significant because this is a reversal in trend that has taken place over the last two years. Nokia has the momentum with new products and the money is flowing into NOK which at present is 19.50 and has a target in the mid 20's

Friday, January 20, 2006

The real estate market in the Northeast is DEAD. In January alone, I suspect business to be down 50-70%. The economy will slowly go into the toilet as the debt-laden consumer has no way out of his debts. The market is tanking today, the DOW is down over 150 points. Oil prices are once again on the rise even though its warm outside. Interest rates as a result should remain low, but there is no one left to borrow. Recession is almost a certainty as the Federal Reserve raised rates until the economy puked. Now its too late for them to do anything. The only thing that is working in investments is energy, gold and stocks of developing countries such as India, since they have all the computer jobs that workers in the US once had for $75,000, which Indians happily work for less than 1/10th the salary.

Monday, January 09, 2006

Two stocks for the new year--(EK) yes Eastman Kodak, and (PAY) Verifone. I like the management for both companies. I know that Kodak has pissed off everyone on Wall Street with their bullshit over the last 15 years. But I really think its different this time. Management finally has a plan and the switch to the digital age for Kodak will finally become reality. Verifone makes automatic credit card verification products. Wireless hand held is the hot new item and as more countries become wealthy, the need for more consumer transactions will naturally spurn growth.

Friday, December 16, 2005

Pfizer (PFE) bottomed out at $20 early this week. It does not have the same lawsuit exposure as Merck (MRK) and it just won a patent case vs. Indian drug manufacturer Ranbaxy. After hours this evening it is over $25. Go back and look at how many times PFE has rallied up 25% in one week. I bet you can count it on one hand in your lifetime. Buy, Buy, Buy!!

The best way to make use of any financial publication--be it Barrons, WSJ, IBD, The Financial Times, is to save any interesting article which focuses on a company you want to invest in for ONE MONTH. If you plunge in the day of the article, you will almost always pay a schmuck tax for all the hype. If the story is still valid one month from now, you will see it in the charts. If not, Mr. Market will have exposed it for the fraud that it is.!

Sunday, December 04, 2005

Technically, the S&P Retail Index (RLX) is forming a head and shoulders top amidst the Holiday Shopping Season. This is not good. Mr. Market is signalling perhaps, that the consumer is tapped out. That the home refinancing boom is over. That discretionary spending is dead. And Mr. Market does not discriminate among economic class lines. Tiffany (TIF) took a dive last week, as did Federated (FD) as did Radio Shack as did Target (TGT)

Tuesday, November 29, 2005

Tuesday, October 04, 2005

Last weeks rally was a feeble attempt at end of quarter mutual fund mark ups. The action was much weaker than expected. This is not how a bull market should behave. October is the cruelest month. Because we were wrong about the strong rally last week, it logically follows that October will be an especially cruel month on the downside. So, anyone with big profits should take a lot off the table before I say, I told you so.

Saturday, September 24, 2005

On Monday morning the stock market will correctly assess what the media has failed to do. After all, the media must over hype everything to keep people watching. But in reality Rita was not Katrina, and the market will have a rally next week that will be "one for the ages" The confluence of events--end of the quarter mark-up by the funds and falling oil prices will be the rocket fuel the market needs. Watch. Insurance, tech, even retail and the homebuilders will rally. Oil will fall like a lead balloon.

Thursday, September 01, 2005

Anyone with half a brain should sell their oil stocks. Remember these prices OXY $83, XOM $61, COP $69. And see what they are trading at a year from now. People have quadrupled their money on this run. Now the greed comes in because of the natural disaster. Put mother nature is telling you to sell not buy.

Wednesday, August 31, 2005

A tragic occurance in New Orleans, and Mississippi, skyrocketing oil prices. What will happen to the economy? My guess is that by this time next year the gas prices will be a lot lower less than $2.50/gallon. The alternative if I am wrong, is ugly. Everyone will stay in and watch movies. The economy will get clobbered. Interest rates will plummet, and Bush will lose the Republican majority in the House and Senate.

Sunday, August 07, 2005

This was Friday's Headline Aug 5, 2005--Touted as the Chinese Google, the search-engine operator opened at more than double the $27 IPO price, then surged for a 354% run to 122.54. Baidu.com was helped by talk that Google, (GOOG) which owns 2.6%, wants to buy it. The 1st-day gain ranks the 18th highest in history and No. 1 for a foreign firm's U.S. IPO. Some other Chinese net firms had solid gains.......Back in 2003 I wrote the following--The next big mania in stocks—China. In the next few years, hundreds if not thousands of new IPO’s will come to the market as Chinese ADR’s. At first, the supply of available companies will be small, causing the stocks to shoot straight up. Mutual funds that invest in China will become the hot funds. Chinese stocks will have internet like valuations as analysts try to justify the run-up using “new era” analysis.Then sometime in late 2006 Time Magazine will declare some Chinese entrepreneur as its Person of the Year. Months later the bubble will burst when the greedy discover that the “emperor has no clothes”; that the valuations were based upon fuzzy Chinese accounting; that there really weren’t any earnings. Sound familiar? The more things change, the more they stay the same.... It looks like we have at least another six months of the Chinese stock mania before it all starts tumbling.

Monday, June 06, 2005

Wednesday, April 27, 2005

Plantronics (NYSE:PLT) has imploded today, down almost 14%. Good things happen to those who wait. Cover half of the position today at about a $12 profit. High downside volume days with news are the best days to cover. You feel just like Eddie Murphy and Dan Akroyd at the end of the movie "Trading Places" when they were able to pick and choose which decimated commodities traders to buy from.

Wednesday, January 05, 2005

Wednesday, December 29, 2004

American Workers enrolled in Flexible Spending Medical Accounts will forfeit $210 million this year. This is money put away paycheck by paycheck for projected medical expenses during the year. The workers are given a tax deduction similar to that of an IRA. If the funds are not used they are forfeited and started anew. On average, workers contribute $250 to $3000 annually to these programs. So the US Government gloms this $210 million from "healthy Americans" and offers $35 million to the victims of the Tsunami. If the US Government conducted all its business this way, we would never have to worry about deficits and the demise of the Social Security System

Monday, December 20, 2004

For 2005 a basket of 5 contrary plays to buy. You have to buy all of them because some will be duds, but as a group, these should outperform the market. Pfizer $25 area (PFE) way over done; Time Warner $19 area (TWX) is this the year they finally spin off AOL?; El Paso $10 (EP) a natural gas company with financial problems; Rite Aid (RAD) $3.75 maybe someone pulls an Eddie Lampert with this one; and Lucent (LU) $3.75 the best of the worst in this beaten down telcom sector.

Subscribe to:

Posts (Atom)